There are still seven 7 tax rates. You dont get a personal allowance on taxable income over 123700. First tax payment when you register the vehicle.

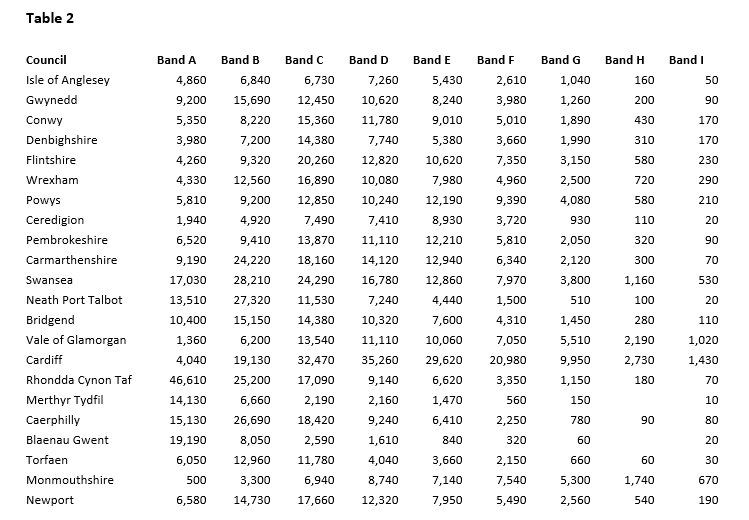

tax band table

2 Council Tax Band Of Owner Occupied Homes Download Table

Tax Rates 2018 Table Rfm Accountants More

Car Tax Bands 2019 Road Tax Rates For New Used Cars

The first is for those in england wales or northern ireland and the second is for those in scotland.

Tax band table.

You have to pay a higher rate for diesel cars that dont meet the real driving emissions 2 rde2 standard for nitrogen oxide emissions.

The highest tax band is band m for cars with co2 emission more than 255 gkm.

Using the table below multiple the p11d value of the vehicle by the car bik tax band percentage rate then multiply that figure by your marginal rate of tax 20 or 40.

The first registration date of the vehicle will also affect dvla tax rates in united kingdom.

Income tax bands are different if you live in scotland.

You can ask your cars manufacturer if your car meets the rde2 standard.

28 diesel over 2000cc.

This increase cannot be transferred between spouses or civil partners.

The big news is of course the tax brackets and tax rates for 2019.

If you live in scotland there are five marginal income tax bands the starter rate of 19 the 20 basic rate the 21 intermediate rate the 41 higher rate and the 46 additional rate.

Ved tables show the bands for dvla vehicle road tax bands for different types of vehicles.

Income tax rates and bands.

The full changes to tax coming into affect this year have been outlined in our april 2017 new car tax rules guide below is a table to show the new car tax bands and rates for new cars registered from april 2017.

To find out your income tax rate see the tables below.

For cars registered from 01 march 2001 to 31 march 2017 car tax bands are labelled by a letter with tax band a referring to cars with co2 emissions up to and including 100 gkm.

Calculating company car tax.

35 petrol gas and conversions.

The increase in the rate band is capped at 25550 or the amount of the income of the lower earner.

Tax rates bands and reliefs.

25 petrol gas and conversions.

You can also see the rates and bands without the personal allowance.

You need to apply the following company car tax table which is based on engine size 0 1400cc.

The following tables show the tax rates rate bands and tax reliefs for the tax year 2018 and the previous tax years.

This payment covers your vehicle for 12 months.

Vehicle road tax rates are usually based on engine size or fuel type and co2 emissions.

Example audi a3 sportback 20 tfsi sport 190ps co2 emissions of 129 equates to a taxable percentage of 26 multiple 23400 by 26.

10 12 22 24 32 35 and 37 there is also a zero rate.

Tax bands b to l relate to vehicle co2 emissions of between 101 and 255 gkm each band having a range 10 15 gkm.

The table shows the tax rates you pay in each band if you have a standard personal allowance of 11850.

15 petrol gas and conversions.

Paying Tax In Ireland What You Need To Know

Tax And Forex Beginner Questions Babypips Com Forex Trading Forum

2019 Uk Car Tax Bands A Guide To Ved Road Tax Car Magazine

Council Tax Mike Hedges Am Welsh Fabians Medium

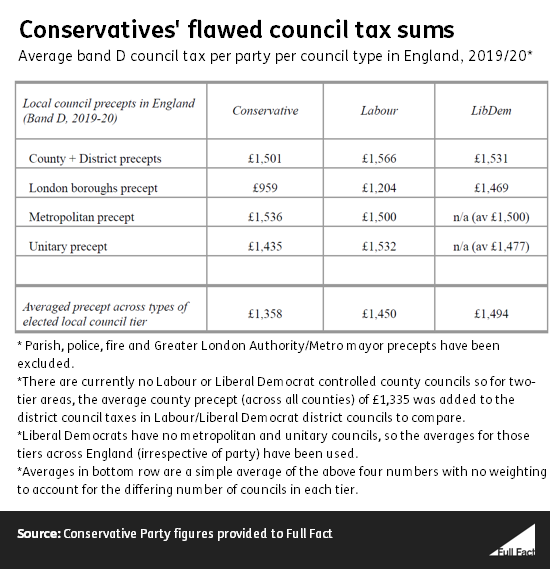

Do Conservative Councils Charge 100 Less Tax Than Labour Or Liberal

The Table Which Shows How Much Property Tax You Ll Have To Pay

Beestonweek Map Showing Council Tax Band A Charges In Broxtowe

Council Tax Charges 2019 20 Broxbourne Gov Uk

2015 Vehicle Tax Covase Fleet Management Company Car Outsourcing

0 comments:

Post a Comment