Luckily if the drive is for business purposes you can claim tax back from hmrc. Gbp british pound. Our currency rankings show that the most popular united kingdom pound exchange rate is the gbp to eur rate.

current ved rates

Ved Rates For Diesels Are Changing We Explain How You Could Be

Should I Lease A Car Through My Limited Company Or Personally

2019 Uk Car Road Tax Bands Explained Auto Express

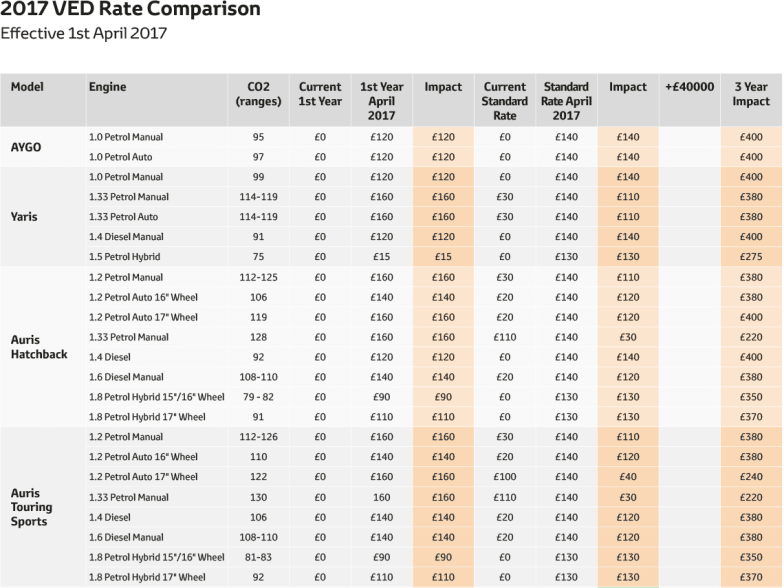

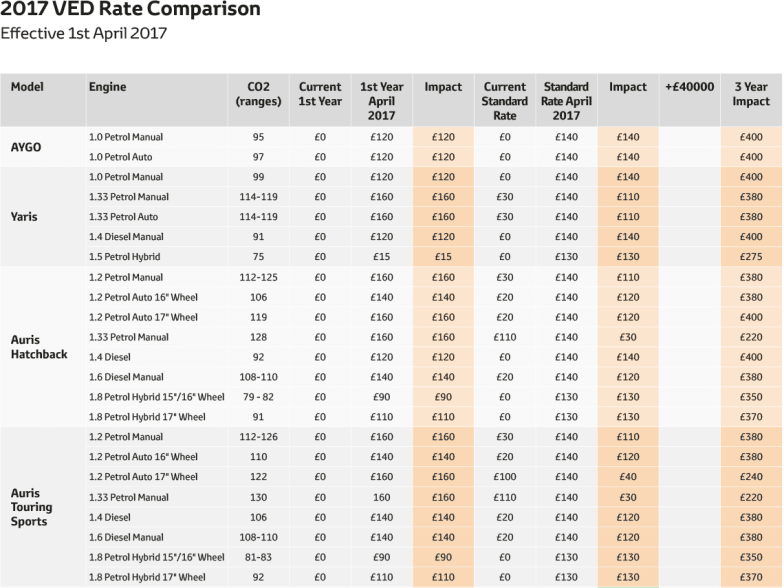

You only have to pay this rate for 5 years from the second time the vehicle is taxed.

Current ved rates.

The british pound is the currency of united kingdom.

You have to pay an extra 310 a year if you have a car or motorhome with a list price the published price before any discounts of more than 40000.

Vehicles with a list price of more than 40000.

According to the latest government statistics british vehicles rack up 324 billion miles a year.

New rates total 4010.

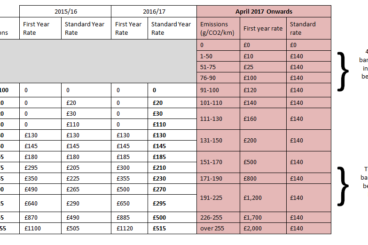

For cars registered from 01 march 2001 to 31 march 2017 car tax bands are labelled by a letter with tax band a referring to cars with co2 emissions up to and including 100 gkm.

Check the list price with your dealer so you know how much vehicle tax youll have to pay.

Tax bands b to l relate to vehicle co2 emissions of between 101 and 255 gkm each band having a range 10 15 gkm.

Below youll find british pound rates and a currency converter.

Uk drivers spend a lot of time on the road.

The additional rate will continue for the following five 5 consecutive years.

For the same model registered after 1 april 2017 ved is 1200 in year one 450 in years 2 to 6 and then 140 from year 7.

Car vehicle tax rates are based on either engine size or fuel type and co2 emissions depending on when the vehicle was.

The currency code for pounds is gbp and the currency symbol is.

What are the current car tax ved rules.

Assuming ten years of ownership pre 2017 rates totalled 3140.

See rates from our weekly national survey of cds mortgages home equity products auto loans.

View todays mortgage interest rates and recent rate trends.

The last major set of road tax changes in april 2017 saw a fixed rate of road tax applied to cars after their first year of registration and these new ved rates are not retrospective so cant be.

Check rates today and lock in your rate.

The rate then returns to the standard annual rate depending on what type of fuel your vehicle uses.

Under the previous rates ved was 620 for the first year and then 280 for each subsequent year.

Calculate vehicle tax rates find out the tax rate for all vehicle types.

Ved tax bands are then based on the fuel type that the vehicle uses with an additional rate of 310 per year.

The first year rate is based on official co2 figures for new diesel cars that dont meet the latest rde2 emissions standards the first year rate assumes that the co2 emissions are one band higher than indicated by official figures.

With this in mind heres a definitive look at the uks business mileage allowance rates for 2019.

Ved tax 201819 cars reg march 2001 to march 2017.

What Are Car Tax Changes In 2018 When Do The New Emissions Tests

Free Road Tax For Cars

Road Tax Rates 2018 With Diesel Supplement Business Car Manager

Dealers Suffered Drop In Private New Car Registrations In February

Ved Tax Rmb Toyota

Uk New Car Market Holds Steady In February Smmt

Update Uk Business Mileage Rates For 2019 2020

Ved Reform Industry Brief 2

Is A Company Car Tax Efficient Osv

0 comments:

Post a Comment